Welcome back to the World of Calligraphy and Design! In this blog, we are looking at the business of calligraphy, art and design. This blog also aims at motivating you to be your own boss!

IntroductionCalligraphy is a unique skill-based artform and a labour-intensive artform. Hence, the number of calligraphers in a given region can be limited. Further, with printing being a common and an inexpensive alternative to hand-written artforms, the demand for this artform is also limited. These 2 factors are the major factors that dictate the price to be charged as a calligrapher.

As an entrepreneur in the field of calligraphy and design, we believe that there are two streams of business in this field. One is the business of supplying goods like basic tools and utilities, required for calligraphy, personalised merchandise and others. The other aspect is offering calligraphy services. This means you can either charge a price for the goods being supplied or for the services being supplied or in some cases a combination of both goods and services.

For instance, one can sell a calligraphy tool kit which is supply of goods, while writing names on a client’s place cards using calligraphy would be supply of services. Please find below an image of the Gift tags we created for a client’s birthday party.

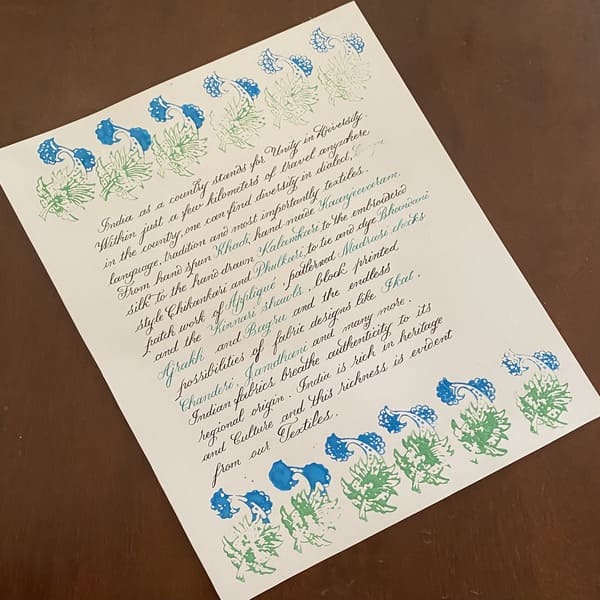

A classic example of a combination of goods and services is a framed poster designed and hand-written using calligraphy wherein the finished piece is a product developed as a result of the calligraphy service. Please find below a commission work we created for a client’s new home!

Hence, this provides an opportunity to price your finished piece as a product, as a service or both. This brings us to the most important question, “How to price?”.

How to price?Before we begin to decide the price, it is important to know “What you want to charge for?”. Is it for the uniqueness of the design as a product or for the effort and time invested in creating this work of art and calligraphy?

Scenario 1: Pricing the finished piecePricing the finished piece is easy when similar products are available on the market. For instance, we want to price a printed guideline book, we can simply compare our product with a reference product that is available on the market. Compare the both in terms of specification and quality to arrive at a fair price. By specification, we refer to number of pages in the book, the thickness of the paper, the design personalisation and so on.

Once we have a reference price, firstly we have to work out the cost involved in creating our product and then add a percentage margin that will become our profit factor. The cost with the margin should be comparable to the reference product.

Please note that you can have a price higher than the reference product’s price depending on your product’s improved specification and quality.

Most important point to keep in mind for pricing with reference products, we should be considerate and not undercut the market to kill the competition. Artists and calligraphers are unique and presence of competition does not define our business presence in the long-term. Being respectful to others in the business always leads to a win-win situation.

In case there is no equivalent product available on the market, Scenario 2 can be applied.

Scenario 2: Pricing for the service offeredThis typically works based on the entire time taken from the design stage till the execution stage. As a calligraphy artist with a special talent, expertise and experience, skill set forms the basis of deciding the charge per character or word. The skill set also dictates the actual time taken to write a single word.

Further, we can also include the tools and supplies involved in the creation of the finished piece. For instance, a special gold ink being used for the writing would be more expensive than a regular black ink.

A summation of all the cost factors will give you a number that you can put on the price tag.

Please note that calligraphy tools and supplies are expensive to source in the world. This is especially true for a country like India with very limited sources being available within the country. This leaves us with no option but to import with applicable duties and taxes.

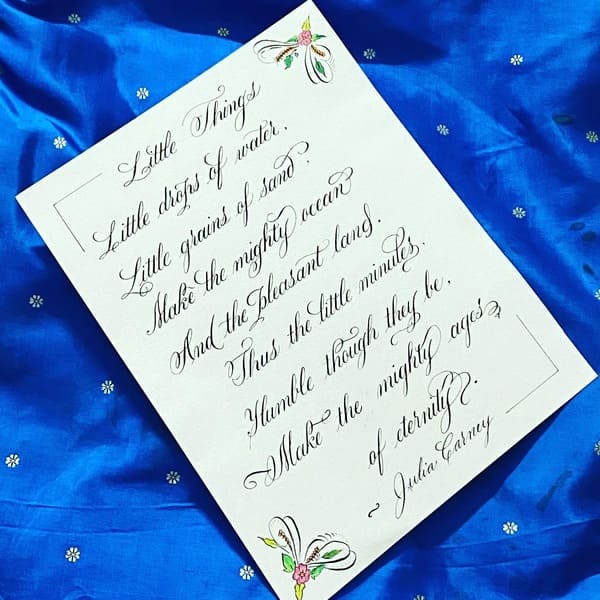

Please find below our recent commission work where we designed a Quote from the Bhagavad Gita for a client. We incorporated illumination with gold work and vine design borders as a decorative feature for the quote.

Calligraphy services can also include conducting workshops and teaching newbies and enthusiasts. Although personally we don’t believe that education should carry a price tag since it is worth one’s lifetime, we decide on a pricing strategy based on the duration of the workshop and our skill-level and not for the knowledge being shared.

Setting up your small businessAs a small business owner, we can vouch that skill and pricing alone are not sufficient to run a business. Based on our expertise in the field of Finance and Accounts as well the experience of running a business, we hereby collate below some of the key aspects of setting up a small business in India.

1. Name thyselfFirst things first, identify the name of your company or brand under which you wish to conduct your business.

2. Nature of the companyFollowing this, decide the nature of the company you want to set-up. This may be proprietorship, partnership, private limited and so on.

3. Business PlanCreate a business plan for your first year. This should include your risk-free minimum investment, product list, potential customers, collaborations and projected turnover.

Your projected turnover for the first year decides the applicable taxation rules. For any new service-based small business in India, during the first year, if the turnover is less than 20 Lakhs (10 lakhs for certain specific regions, please refer to the official GST website for detailed information), GST registration is waived.

However, if you are confident in securing consistent orders and achieving an estimated turnover, you can register for GST and collect and pay taxes to avail the benefits that come with it.

Benefits of GSTBenefits of GST include recognition, MSME registration, ease of availing loans, registering trademarks and copyrights for your designs and accumulating and availing input tax credit.

Recognition through GST registration is especially important when working with brands and large companies who prefer to conduct their business only on B2B basis and not on B2C basis.

Further, GST registration is important for banking purposes, loan availing purposes and for MSME registration and MSME benefit.

Input tax CreditITC or Input Tax Credit is of great significance for any business that involves purchase and sales. If you are buying locally or importing calligraphy tools and supplies to sell to your customers, you may be charged with the region-specific taxes (input tax) and duties (for import) on the cost of the purchased products. With GST registration, you can apply taxes on products you sell (output tax) to your customers and off-set this against the input tax and this process is called availing input tax credit. Under such circumstances, you only have to pay the nett tax to the government and the input tax will not become a cost factor to you.

In case you fall within the threshold of GST waiver, you can accumulate the input tax until you cross the threshold for charging output tax in your bill and off-set the accumulated amount against your sales. This will be of great benefit to your business to cut down the capital costs you incur during procurement.

You can weigh the pros and cons of GST registration as a small business owner and then make a beneficial decision.

Closing remark:As a small business owner, don’t underestimate the true worth of your skills and services but at the same time don’t let go of any opportunity to make money whether it is through suppy of calligraphy tools, personalised merchandise, calligraphy services, brand collaborations or teaching to enthusiasts through workshops. We wish you the best in your endeavours.

Glossary:B2B: Business to Business

B2C: Business to Customer

MSME: Micro, Small & Medium Enterprises

GST: Goods and Services Tax

Comments

AndrewDiowl

1091m2love – Unique name, design feels artistic and expression of individuality.

AndrewDiowl

1091m2love – Unique name, design feels artistic and expression of individuality.

AndrewDiowl

1091m2love – Unique name, design feels artistic and expression of individuality.

AndrewDiowl

1091m2love – Unique name, design feels artistic and expression of individuality.

AndrewDiowl

1091m2love – Unique name, design feels artistic and expression of individuality.

AndrewDiowl

1091m2love – Unique name, design feels artistic and expression of individuality.

AndrewDiowl

1091m2love – Unique name, design feels artistic and expression of individuality.

AndrewDiowl

1091m2love – Unique name, design feels artistic and expression of individuality.

AndrewDiowl

1091m2love – Unique name, design feels artistic and expression of individuality.

AndrewDiowl

1091m2love – Unique name, design feels artistic and expression of individuality.

AndrewDiowl

1091m2love – Unique name, design feels artistic and expression of individuality.

AndrewDiowl

1091m2love – Unique name, design feels artistic and expression of individuality.

AndrewDiowl

1091m2love – Unique name, design feels artistic and expression of individuality.

AndrewDiowl

1091m2love – Unique name, design feels artistic and expression of individuality.

AndrewDiowl

1091m2love – Unique name, design feels artistic and expression of individuality.

AndrewDiowl

1091m2love – Unique name, design feels artistic and expression of individuality.

AndrewDiowl

1091m2love – Unique name, design feels artistic and expression of individuality.

AndrewDiowl

1091m2love – Unique name, design feels artistic and expression of individuality.

AndrewDiowl

1091m2love – Unique name, design feels artistic and expression of individuality.

AndrewDiowl

1091m2love – Unique name, design feels artistic and expression of individuality.

AndrewDiowl

1091m2love – Unique name, design feels artistic and expression of individuality.

AndrewDiowl

1091m2love – Unique name, design feels artistic and expression of individuality.

AndrewDiowl

1091m2love – Unique name, design feels artistic and expression of individuality.

AndrewDiowl

1091m2love – Unique name, design feels artistic and expression of individuality.

AndrewDiowl

1091m2love – Unique name, design feels artistic and expression of individuality.

AndrewDiowl

1091m2love – Unique name, design feels artistic and expression of individuality.

AndrewDiowl

1091m2love – Unique name, design feels artistic and expression of individuality.

AndrewDiowl

1091m2love – Unique name, design feels artistic and expression of individuality.

AndrewDiowl

1091m2love – Unique name, design feels artistic and expression of individuality.

AndrewDiowl

1091m2love – Unique name, design feels artistic and expression of individuality.

zaimy-online-937

займ без проверок оформить займ без фото документов

zaem-90

беспроцентный займ https://zaimy-61.ru

online-zaymy-486

займ без переплат займ на карту за несколько минут

Stevensep

embersk9wish – Heartwarming mission, site honors service dogs with love and gratitude.

MichaelFaP

скачать с вконтакте

Stevensep

embersk9wish – Heartwarming mission, site honors service dogs with love and gratitude.

Stevensep

embersk9wish – Heartwarming mission, site honors service dogs with love and gratitude.

Stevensep

embersk9wish – Heartwarming mission, site honors service dogs with love and gratitude.

Stevensep

embersk9wish – Heartwarming mission, site honors service dogs with love and gratitude.

Stevensep

embersk9wish – Heartwarming mission, site honors service dogs with love and gratitude.

Stevensep

embersk9wish – Heartwarming mission, site honors service dogs with love and gratitude.

Stevensep

embersk9wish – Heartwarming mission, site honors service dogs with love and gratitude.

Stevensep

embersk9wish – Heartwarming mission, site honors service dogs with love and gratitude.

Stevensep

embersk9wish – Heartwarming mission, site honors service dogs with love and gratitude.

Stevensep

embersk9wish – Heartwarming mission, site honors service dogs with love and gratitude.

Stevensep

embersk9wish – Heartwarming mission, site honors service dogs with love and gratitude.

Stevensep

embersk9wish – Heartwarming mission, site honors service dogs with love and gratitude.

Stevensep

embersk9wish – Heartwarming mission, site honors service dogs with love and gratitude.

Stevensep

embersk9wish – Heartwarming mission, site honors service dogs with love and gratitude.

Stevensep

embersk9wish – Heartwarming mission, site honors service dogs with love and gratitude.

Stevensep

embersk9wish – Heartwarming mission, site honors service dogs with love and gratitude.

Stevensep

embersk9wish – Heartwarming mission, site honors service dogs with love and gratitude.

Stevensep

embersk9wish – Heartwarming mission, site honors service dogs with love and gratitude.

Stevensep

embersk9wish – Heartwarming mission, site honors service dogs with love and gratitude.

Stevensep

embersk9wish – Heartwarming mission, site honors service dogs with love and gratitude.

Stevensep

embersk9wish – Heartwarming mission, site honors service dogs with love and gratitude.

Stevensep

embersk9wish – Heartwarming mission, site honors service dogs with love and gratitude.

Stevensep

embersk9wish – Heartwarming mission, site honors service dogs with love and gratitude.

Stevensep

embersk9wish – Heartwarming mission, site honors service dogs with love and gratitude.

Stevensep

embersk9wish – Heartwarming mission, site honors service dogs with love and gratitude.

Stevensep

embersk9wish – Heartwarming mission, site honors service dogs with love and gratitude.

Stevensep

embersk9wish – Heartwarming mission, site honors service dogs with love and gratitude.

Stevensep

embersk9wish – Heartwarming mission, site honors service dogs with love and gratitude.

Stevensep

embersk9wish – Heartwarming mission, site honors service dogs with love and gratitude.

zaimy-online-756

займ с плохой кредитной https://zaimy-65.ru

online-zaymy-374

взять займ онлайн https://zaimy-63.ru

zaem-212

займ срочно без отказа займ всем

TrumanLam

??????? ??????? ?????????? ?? ?????????? ???????????????. ?????? ?????, ?? ????????? ?? ??????????? ????????????, ??? ???????. ???? ?????? ??????? ?????? ? ????????????. ??????? ???????? ?? ???????? ??????, ???? ??? ????????? ????????????. fortuna-distillery ???????? ?????? ???????????, ? ???????????? ?????????. ?? ??? ??????? ?????????????, ?????? ? ???? ????????. ????????? ???????? ?????? ??????? ???????? ?????. ?????????? ???????????? ???????, ?? ????????? ?????????? ????.

zaim online 970

нужен займ мфо https://zaimy-59.ru

zaimy 983

денежный кредит займ https://zaimy-57.ru

zaymy onlayn 241

займ онлайн без отказа https://zaimy-54.ru

Paulcralp

jammykspeaks – Powerful voice, content feels authentic, motivational and full of passion.

Paulcralp

jammykspeaks – Powerful voice, content feels authentic, motivational and full of passion.

Paulcralp

jammykspeaks – Powerful voice, content feels authentic, motivational and full of passion.

Paulcralp

jammykspeaks – Powerful voice, content feels authentic, motivational and full of passion.

Paulcralp

jammykspeaks – Powerful voice, content feels authentic, motivational and full of passion.

Paulcralp

jammykspeaks – Powerful voice, content feels authentic, motivational and full of passion.

Paulcralp

jammykspeaks – Powerful voice, content feels authentic, motivational and full of passion.

Paulcralp

jammykspeaks – Powerful voice, content feels authentic, motivational and full of passion.

Paulcralp

jammykspeaks – Powerful voice, content feels authentic, motivational and full of passion.

Paulcralp

jammykspeaks – Powerful voice, content feels authentic, motivational and full of passion.

Paulcralp

jammykspeaks – Powerful voice, content feels authentic, motivational and full of passion.

Paulcralp

jammykspeaks – Powerful voice, content feels authentic, motivational and full of passion.

Paulcralp

jammykspeaks – Powerful voice, content feels authentic, motivational and full of passion.

Paulcralp

jammykspeaks – Powerful voice, content feels authentic, motivational and full of passion.

Paulcralp

jammykspeaks – Powerful voice, content feels authentic, motivational and full of passion.

Paulcralp

jammykspeaks – Powerful voice, content feels authentic, motivational and full of passion.

Paulcralp

jammykspeaks – Powerful voice, content feels authentic, motivational and full of passion.

Paulcralp

jammykspeaks – Powerful voice, content feels authentic, motivational and full of passion.

Paulcralp

jammykspeaks – Powerful voice, content feels authentic, motivational and full of passion.

Paulcralp

jammykspeaks – Powerful voice, content feels authentic, motivational and full of passion.

Paulcralp

jammykspeaks – Powerful voice, content feels authentic, motivational and full of passion.

Paulcralp

jammykspeaks – Powerful voice, content feels authentic, motivational and full of passion.

Paulcralp

jammykspeaks – Powerful voice, content feels authentic, motivational and full of passion.

Paulcralp

jammykspeaks – Powerful voice, content feels authentic, motivational and full of passion.

Paulcralp

jammykspeaks – Powerful voice, content feels authentic, motivational and full of passion.

Paulcralp

jammykspeaks – Powerful voice, content feels authentic, motivational and full of passion.

Paulcralp

jammykspeaks – Powerful voice, content feels authentic, motivational and full of passion.

Paulcralp

jammykspeaks – Powerful voice, content feels authentic, motivational and full of passion.

Paulcralp

jammykspeaks – Powerful voice, content feels authentic, motivational and full of passion.

Paulcralp

jammykspeaks – Powerful voice, content feels authentic, motivational and full of passion.

MarkGuamn

walkunchained – Inspiring tone, message of freedom and courage comes across clearly.

MarkGuamn

walkunchained – Inspiring tone, message of freedom and courage comes across clearly.

MarkGuamn

walkunchained – Inspiring tone, message of freedom and courage comes across clearly.

MarkGuamn

walkunchained – Inspiring tone, message of freedom and courage comes across clearly.

MarkGuamn

walkunchained – Inspiring tone, message of freedom and courage comes across clearly.

MarkGuamn

walkunchained – Inspiring tone, message of freedom and courage comes across clearly.

MarkGuamn

walkunchained – Inspiring tone, message of freedom and courage comes across clearly.

MarkGuamn

walkunchained – Inspiring tone, message of freedom and courage comes across clearly.

MarkGuamn

walkunchained – Inspiring tone, message of freedom and courage comes across clearly.

MarkGuamn

walkunchained – Inspiring tone, message of freedom and courage comes across clearly.

MarkGuamn

walkunchained – Inspiring tone, message of freedom and courage comes across clearly.

MarkGuamn

walkunchained – Inspiring tone, message of freedom and courage comes across clearly.

MarkGuamn

walkunchained – Inspiring tone, message of freedom and courage comes across clearly.

MarkGuamn

walkunchained – Inspiring tone, message of freedom and courage comes across clearly.

MarkGuamn

walkunchained – Inspiring tone, message of freedom and courage comes across clearly.

MarkGuamn

walkunchained – Inspiring tone, message of freedom and courage comes across clearly.

MarkGuamn

walkunchained – Inspiring tone, message of freedom and courage comes across clearly.

MarkGuamn

walkunchained – Inspiring tone, message of freedom and courage comes across clearly.

MarkGuamn

walkunchained – Inspiring tone, message of freedom and courage comes across clearly.

MarkGuamn

walkunchained – Inspiring tone, message of freedom and courage comes across clearly.

MarkGuamn

walkunchained – Inspiring tone, message of freedom and courage comes across clearly.

MarkGuamn

walkunchained – Inspiring tone, message of freedom and courage comes across clearly.

MarkGuamn

walkunchained – Inspiring tone, message of freedom and courage comes across clearly.

MarkGuamn

walkunchained – Inspiring tone, message of freedom and courage comes across clearly.

MarkGuamn

walkunchained – Inspiring tone, message of freedom and courage comes across clearly.

MarkGuamn

walkunchained – Inspiring tone, message of freedom and courage comes across clearly.

MarkGuamn

walkunchained – Inspiring tone, message of freedom and courage comes across clearly.

MarkGuamn

walkunchained – Inspiring tone, message of freedom and courage comes across clearly.

MarkGuamn

walkunchained – Inspiring tone, message of freedom and courage comes across clearly.

MarkGuamn

walkunchained – Inspiring tone, message of freedom and courage comes across clearly.

AnthonyObete

tranquilleeyecream – Calm aesthetic, visuals match beauty and relaxation concept perfectly.

AnthonyObete

tranquilleeyecream – Calm aesthetic, visuals match beauty and relaxation concept perfectly.

AnthonyObete

tranquilleeyecream – Calm aesthetic, visuals match beauty and relaxation concept perfectly.

AnthonyObete

tranquilleeyecream – Calm aesthetic, visuals match beauty and relaxation concept perfectly.

AnthonyObete

tranquilleeyecream – Calm aesthetic, visuals match beauty and relaxation concept perfectly.

AnthonyObete

tranquilleeyecream – Calm aesthetic, visuals match beauty and relaxation concept perfectly.

AnthonyObete

tranquilleeyecream – Calm aesthetic, visuals match beauty and relaxation concept perfectly.

AnthonyObete

tranquilleeyecream – Calm aesthetic, visuals match beauty and relaxation concept perfectly.

AnthonyObete

tranquilleeyecream – Calm aesthetic, visuals match beauty and relaxation concept perfectly.

AnthonyObete

tranquilleeyecream – Calm aesthetic, visuals match beauty and relaxation concept perfectly.

AnthonyObete

tranquilleeyecream – Calm aesthetic, visuals match beauty and relaxation concept perfectly.

AnthonyObete

tranquilleeyecream – Calm aesthetic, visuals match beauty and relaxation concept perfectly.

AnthonyObete

tranquilleeyecream – Calm aesthetic, visuals match beauty and relaxation concept perfectly.

AnthonyObete

tranquilleeyecream – Calm aesthetic, visuals match beauty and relaxation concept perfectly.

AnthonyObete

tranquilleeyecream – Calm aesthetic, visuals match beauty and relaxation concept perfectly.

AnthonyObete

tranquilleeyecream – Calm aesthetic, visuals match beauty and relaxation concept perfectly.

AnthonyObete

tranquilleeyecream – Calm aesthetic, visuals match beauty and relaxation concept perfectly.

AnthonyObete

tranquilleeyecream – Calm aesthetic, visuals match beauty and relaxation concept perfectly.

AnthonyObete

tranquilleeyecream – Calm aesthetic, visuals match beauty and relaxation concept perfectly.

AnthonyObete

tranquilleeyecream – Calm aesthetic, visuals match beauty and relaxation concept perfectly.

AnthonyObete

tranquilleeyecream – Calm aesthetic, visuals match beauty and relaxation concept perfectly.

AnthonyObete

tranquilleeyecream – Calm aesthetic, visuals match beauty and relaxation concept perfectly.

AnthonyObete

tranquilleeyecream – Calm aesthetic, visuals match beauty and relaxation concept perfectly.

AnthonyObete

tranquilleeyecream – Calm aesthetic, visuals match beauty and relaxation concept perfectly.

AnthonyObete

tranquilleeyecream – Calm aesthetic, visuals match beauty and relaxation concept perfectly.

AnthonyObete

tranquilleeyecream – Calm aesthetic, visuals match beauty and relaxation concept perfectly.

AnthonyObete

tranquilleeyecream – Calm aesthetic, visuals match beauty and relaxation concept perfectly.

AnthonyObete

tranquilleeyecream – Calm aesthetic, visuals match beauty and relaxation concept perfectly.

AnthonyObete

tranquilleeyecream – Calm aesthetic, visuals match beauty and relaxation concept perfectly.

AnthonyObete

tranquilleeyecream – Calm aesthetic, visuals match beauty and relaxation concept perfectly.

MatthewMoume

stopkrasner – Strong political tone, site expresses clear intent and decisive messaging.

MatthewMoume

stopkrasner – Strong political tone, site expresses clear intent and decisive messaging.

MatthewMoume

stopkrasner – Strong political tone, site expresses clear intent and decisive messaging.

MatthewMoume

stopkrasner – Strong political tone, site expresses clear intent and decisive messaging.

MatthewMoume

stopkrasner – Strong political tone, site expresses clear intent and decisive messaging.

MatthewMoume

stopkrasner – Strong political tone, site expresses clear intent and decisive messaging.

MatthewMoume

stopkrasner – Strong political tone, site expresses clear intent and decisive messaging.

MatthewMoume

stopkrasner – Strong political tone, site expresses clear intent and decisive messaging.

MatthewMoume

stopkrasner – Strong political tone, site expresses clear intent and decisive messaging.

MatthewMoume

stopkrasner – Strong political tone, site expresses clear intent and decisive messaging.

MatthewMoume

stopkrasner – Strong political tone, site expresses clear intent and decisive messaging.

MatthewMoume

stopkrasner – Strong political tone, site expresses clear intent and decisive messaging.

MatthewMoume

stopkrasner – Strong political tone, site expresses clear intent and decisive messaging.

MatthewMoume

stopkrasner – Strong political tone, site expresses clear intent and decisive messaging.

MatthewMoume

stopkrasner – Strong political tone, site expresses clear intent and decisive messaging.

MatthewMoume

stopkrasner – Strong political tone, site expresses clear intent and decisive messaging.

MatthewMoume

stopkrasner – Strong political tone, site expresses clear intent and decisive messaging.

MatthewMoume

stopkrasner – Strong political tone, site expresses clear intent and decisive messaging.

MatthewMoume

stopkrasner – Strong political tone, site expresses clear intent and decisive messaging.

MatthewMoume

stopkrasner – Strong political tone, site expresses clear intent and decisive messaging.

MatthewMoume

stopkrasner – Strong political tone, site expresses clear intent and decisive messaging.

MatthewMoume

stopkrasner – Strong political tone, site expresses clear intent and decisive messaging.

MatthewMoume

stopkrasner – Strong political tone, site expresses clear intent and decisive messaging.

MatthewMoume

stopkrasner – Strong political tone, site expresses clear intent and decisive messaging.

MatthewMoume

stopkrasner – Strong political tone, site expresses clear intent and decisive messaging.

MatthewMoume

stopkrasner – Strong political tone, site expresses clear intent and decisive messaging.

MatthewMoume

stopkrasner – Strong political tone, site expresses clear intent and decisive messaging.

MatthewMoume

stopkrasner – Strong political tone, site expresses clear intent and decisive messaging.

MatthewMoume

stopkrasner – Strong political tone, site expresses clear intent and decisive messaging.

MatthewMoume

stopkrasner – Strong political tone, site expresses clear intent and decisive messaging.

JessieCrymn

https://factava.com.ua/znachennya-imen/ester-znachennia-imeni-rozkryttia-taiemnyts-imeni-yoho-vplyv-na-kharakter-i-zhyttia/

Danielpedge

albanysuperducks – Fun and quirky, visuals bring playful excitement to life.

Danielpedge

albanysuperducks – Fun and quirky, visuals bring playful excitement to life.

Danielpedge

albanysuperducks – Fun and quirky, visuals bring playful excitement to life.

Danielpedge

albanysuperducks – Fun and quirky, visuals bring playful excitement to life.

Danielpedge

albanysuperducks – Fun and quirky, visuals bring playful excitement to life.

Danielpedge

albanysuperducks – Fun and quirky, visuals bring playful excitement to life.

Danielpedge

albanysuperducks – Fun and quirky, visuals bring playful excitement to life.

Danielpedge

albanysuperducks – Fun and quirky, visuals bring playful excitement to life.

Danielpedge

albanysuperducks – Fun and quirky, visuals bring playful excitement to life.

Danielpedge

albanysuperducks – Fun and quirky, visuals bring playful excitement to life.

Danielpedge

albanysuperducks – Fun and quirky, visuals bring playful excitement to life.

Danielpedge

albanysuperducks – Fun and quirky, visuals bring playful excitement to life.

Danielpedge

albanysuperducks – Fun and quirky, visuals bring playful excitement to life.

Danielpedge

albanysuperducks – Fun and quirky, visuals bring playful excitement to life.

Danielpedge

albanysuperducks – Fun and quirky, visuals bring playful excitement to life.

Danielpedge

albanysuperducks – Fun and quirky, visuals bring playful excitement to life.

Danielpedge

albanysuperducks – Fun and quirky, visuals bring playful excitement to life.

Danielpedge

albanysuperducks – Fun and quirky, visuals bring playful excitement to life.

Danielpedge

albanysuperducks – Fun and quirky, visuals bring playful excitement to life.

Danielpedge

albanysuperducks – Fun and quirky, visuals bring playful excitement to life.

Danielpedge

albanysuperducks – Fun and quirky, visuals bring playful excitement to life.

Danielpedge

albanysuperducks – Fun and quirky, visuals bring playful excitement to life.

Danielpedge

albanysuperducks – Fun and quirky, visuals bring playful excitement to life.

Danielpedge

albanysuperducks – Fun and quirky, visuals bring playful excitement to life.

Danielpedge

albanysuperducks – Fun and quirky, visuals bring playful excitement to life.

Danielpedge

albanysuperducks – Fun and quirky, visuals bring playful excitement to life.

Danielpedge

albanysuperducks – Fun and quirky, visuals bring playful excitement to life.

Danielpedge

albanysuperducks – Fun and quirky, visuals bring playful excitement to life.

Danielpedge

albanysuperducks – Fun and quirky, visuals bring playful excitement to life.

Danielpedge

albanysuperducks – Fun and quirky, visuals bring playful excitement to life.

Christophercycle

saveshelterpets – Touching initiative, site feels compassionate and community-focused.

Christophercycle

saveshelterpets – Touching initiative, site feels compassionate and community-focused.

Christophercycle

saveshelterpets – Touching initiative, site feels compassionate and community-focused.

Christophercycle

saveshelterpets – Touching initiative, site feels compassionate and community-focused.

Christophercycle

saveshelterpets – Touching initiative, site feels compassionate and community-focused.

Christophercycle

saveshelterpets – Touching initiative, site feels compassionate and community-focused.

Christophercycle

saveshelterpets – Touching initiative, site feels compassionate and community-focused.

Christophercycle

saveshelterpets – Touching initiative, site feels compassionate and community-focused.

Christophercycle

saveshelterpets – Touching initiative, site feels compassionate and community-focused.

Christophercycle

saveshelterpets – Touching initiative, site feels compassionate and community-focused.

Christophercycle

saveshelterpets – Touching initiative, site feels compassionate and community-focused.

Christophercycle

saveshelterpets – Touching initiative, site feels compassionate and community-focused.

Christophercycle

saveshelterpets – Touching initiative, site feels compassionate and community-focused.

Christophercycle

saveshelterpets – Touching initiative, site feels compassionate and community-focused.

Christophercycle

saveshelterpets – Touching initiative, site feels compassionate and community-focused.

Christophercycle

saveshelterpets – Touching initiative, site feels compassionate and community-focused.

Christophercycle

saveshelterpets – Touching initiative, site feels compassionate and community-focused.

Christophercycle

saveshelterpets – Touching initiative, site feels compassionate and community-focused.

Christophercycle

saveshelterpets – Touching initiative, site feels compassionate and community-focused.

Christophercycle

saveshelterpets – Touching initiative, site feels compassionate and community-focused.

Christophercycle

saveshelterpets – Touching initiative, site feels compassionate and community-focused.

Christophercycle

saveshelterpets – Touching initiative, site feels compassionate and community-focused.

Christophercycle

saveshelterpets – Touching initiative, site feels compassionate and community-focused.

Christophercycle

saveshelterpets – Touching initiative, site feels compassionate and community-focused.

Christophercycle

saveshelterpets – Touching initiative, site feels compassionate and community-focused.

Christophercycle

saveshelterpets – Touching initiative, site feels compassionate and community-focused.

Christophercycle

saveshelterpets – Touching initiative, site feels compassionate and community-focused.

Christophercycle

saveshelterpets – Touching initiative, site feels compassionate and community-focused.

Christophercycle

saveshelterpets – Touching initiative, site feels compassionate and community-focused.

Christophercycle

saveshelterpets – Touching initiative, site feels compassionate and community-focused.

ThomasLoods

georgetowndowntownmasterplan – Informative and civic-minded, content clearly explains planning goals.

ThomasLoods

georgetowndowntownmasterplan – Informative and civic-minded, content clearly explains planning goals.

ThomasLoods

georgetowndowntownmasterplan – Informative and civic-minded, content clearly explains planning goals.

ThomasLoods

georgetowndowntownmasterplan – Informative and civic-minded, content clearly explains planning goals.

ThomasLoods

georgetowndowntownmasterplan – Informative and civic-minded, content clearly explains planning goals.

ThomasLoods

georgetowndowntownmasterplan – Informative and civic-minded, content clearly explains planning goals.

ThomasLoods

georgetowndowntownmasterplan – Informative and civic-minded, content clearly explains planning goals.

ThomasLoods

georgetowndowntownmasterplan – Informative and civic-minded, content clearly explains planning goals.

ThomasLoods

georgetowndowntownmasterplan – Informative and civic-minded, content clearly explains planning goals.

ThomasLoods

georgetowndowntownmasterplan – Informative and civic-minded, content clearly explains planning goals.

ThomasLoods

georgetowndowntownmasterplan – Informative and civic-minded, content clearly explains planning goals.

ThomasLoods

georgetowndowntownmasterplan – Informative and civic-minded, content clearly explains planning goals.

ThomasLoods

georgetowndowntownmasterplan – Informative and civic-minded, content clearly explains planning goals.

ThomasLoods

georgetowndowntownmasterplan – Informative and civic-minded, content clearly explains planning goals.

ThomasLoods

georgetowndowntownmasterplan – Informative and civic-minded, content clearly explains planning goals.

ThomasLoods

georgetowndowntownmasterplan – Informative and civic-minded, content clearly explains planning goals.

ThomasLoods

georgetowndowntownmasterplan – Informative and civic-minded, content clearly explains planning goals.

ThomasLoods

georgetowndowntownmasterplan – Informative and civic-minded, content clearly explains planning goals.

ThomasLoods

georgetowndowntownmasterplan – Informative and civic-minded, content clearly explains planning goals.

ThomasLoods

georgetowndowntownmasterplan – Informative and civic-minded, content clearly explains planning goals.

ThomasLoods

georgetowndowntownmasterplan – Informative and civic-minded, content clearly explains planning goals.

ThomasLoods

georgetowndowntownmasterplan – Informative and civic-minded, content clearly explains planning goals.

ThomasLoods

georgetowndowntownmasterplan – Informative and civic-minded, content clearly explains planning goals.

ThomasLoods

georgetowndowntownmasterplan – Informative and civic-minded, content clearly explains planning goals.

ThomasLoods

georgetowndowntownmasterplan – Informative and civic-minded, content clearly explains planning goals.

ThomasLoods

georgetowndowntownmasterplan – Informative and civic-minded, content clearly explains planning goals.

ThomasLoods

georgetowndowntownmasterplan – Informative and civic-minded, content clearly explains planning goals.

ThomasLoods

georgetowndowntownmasterplan – Informative and civic-minded, content clearly explains planning goals.

ThomasLoods

georgetowndowntownmasterplan – Informative and civic-minded, content clearly explains planning goals.

ThomasLoods

georgetowndowntownmasterplan – Informative and civic-minded, content clearly explains planning goals.

MichaelAlure

Похоронные услуги с кремацией

Williamgat

cranberrystreetcafe – Cozy and charming, design evokes warmth and delicious experiences.

Williamgat

cranberrystreetcafe – Cozy and charming, design evokes warmth and delicious experiences.

Williamgat

cranberrystreetcafe – Cozy and charming, design evokes warmth and delicious experiences.

Williamgat

cranberrystreetcafe – Cozy and charming, design evokes warmth and delicious experiences.

Williamgat

cranberrystreetcafe – Cozy and charming, design evokes warmth and delicious experiences.

Williamgat

cranberrystreetcafe – Cozy and charming, design evokes warmth and delicious experiences.

Williamgat

cranberrystreetcafe – Cozy and charming, design evokes warmth and delicious experiences.

Williamgat

cranberrystreetcafe – Cozy and charming, design evokes warmth and delicious experiences.

Williamgat

cranberrystreetcafe – Cozy and charming, design evokes warmth and delicious experiences.

Williamgat

cranberrystreetcafe – Cozy and charming, design evokes warmth and delicious experiences.

Williamgat

cranberrystreetcafe – Cozy and charming, design evokes warmth and delicious experiences.

Williamgat

cranberrystreetcafe – Cozy and charming, design evokes warmth and delicious experiences.

Williamgat

cranberrystreetcafe – Cozy and charming, design evokes warmth and delicious experiences.

Williamgat

cranberrystreetcafe – Cozy and charming, design evokes warmth and delicious experiences.

Williamgat

cranberrystreetcafe – Cozy and charming, design evokes warmth and delicious experiences.

Williamgat

cranberrystreetcafe – Cozy and charming, design evokes warmth and delicious experiences.

Williamgat

cranberrystreetcafe – Cozy and charming, design evokes warmth and delicious experiences.

Williamgat

cranberrystreetcafe – Cozy and charming, design evokes warmth and delicious experiences.

Williamgat

cranberrystreetcafe – Cozy and charming, design evokes warmth and delicious experiences.

Williamgat

cranberrystreetcafe – Cozy and charming, design evokes warmth and delicious experiences.

Williamgat

cranberrystreetcafe – Cozy and charming, design evokes warmth and delicious experiences.

Williamgat

cranberrystreetcafe – Cozy and charming, design evokes warmth and delicious experiences.

Williamgat

cranberrystreetcafe – Cozy and charming, design evokes warmth and delicious experiences.

Williamgat

cranberrystreetcafe – Cozy and charming, design evokes warmth and delicious experiences.

Williamgat

cranberrystreetcafe – Cozy and charming, design evokes warmth and delicious experiences.

Williamgat

cranberrystreetcafe – Cozy and charming, design evokes warmth and delicious experiences.

Williamgat

cranberrystreetcafe – Cozy and charming, design evokes warmth and delicious experiences.

Williamgat

cranberrystreetcafe – Cozy and charming, design evokes warmth and delicious experiences.

Williamgat

cranberrystreetcafe – Cozy and charming, design evokes warmth and delicious experiences.

Williamgat

cranberrystreetcafe – Cozy and charming, design evokes warmth and delicious experiences.

Robertkem

t-walls-of-kuwait-iraq – Historical and impactful, visuals convey memory and meaning strongly.

Robertkem

t-walls-of-kuwait-iraq – Historical and impactful, visuals convey memory and meaning strongly.

Robertkem

t-walls-of-kuwait-iraq – Historical and impactful, visuals convey memory and meaning strongly.

Robertkem

t-walls-of-kuwait-iraq – Historical and impactful, visuals convey memory and meaning strongly.

Robertkem

t-walls-of-kuwait-iraq – Historical and impactful, visuals convey memory and meaning strongly.

Robertkem

t-walls-of-kuwait-iraq – Historical and impactful, visuals convey memory and meaning strongly.

Robertkem

t-walls-of-kuwait-iraq – Historical and impactful, visuals convey memory and meaning strongly.

Robertkem

t-walls-of-kuwait-iraq – Historical and impactful, visuals convey memory and meaning strongly.

Robertkem

t-walls-of-kuwait-iraq – Historical and impactful, visuals convey memory and meaning strongly.

Robertkem

t-walls-of-kuwait-iraq – Historical and impactful, visuals convey memory and meaning strongly.

Robertkem

t-walls-of-kuwait-iraq – Historical and impactful, visuals convey memory and meaning strongly.

Robertkem

t-walls-of-kuwait-iraq – Historical and impactful, visuals convey memory and meaning strongly.

Robertkem

t-walls-of-kuwait-iraq – Historical and impactful, visuals convey memory and meaning strongly.

Robertkem

t-walls-of-kuwait-iraq – Historical and impactful, visuals convey memory and meaning strongly.

Robertkem

t-walls-of-kuwait-iraq – Historical and impactful, visuals convey memory and meaning strongly.

Robertkem

t-walls-of-kuwait-iraq – Historical and impactful, visuals convey memory and meaning strongly.

Robertkem

t-walls-of-kuwait-iraq – Historical and impactful, visuals convey memory and meaning strongly.

Robertkem

t-walls-of-kuwait-iraq – Historical and impactful, visuals convey memory and meaning strongly.

Robertkem

t-walls-of-kuwait-iraq – Historical and impactful, visuals convey memory and meaning strongly.

Robertkem

t-walls-of-kuwait-iraq – Historical and impactful, visuals convey memory and meaning strongly.

Robertkem

t-walls-of-kuwait-iraq – Historical and impactful, visuals convey memory and meaning strongly.

Robertkem

t-walls-of-kuwait-iraq – Historical and impactful, visuals convey memory and meaning strongly.

Robertkem

t-walls-of-kuwait-iraq – Historical and impactful, visuals convey memory and meaning strongly.

Robertkem

t-walls-of-kuwait-iraq – Historical and impactful, visuals convey memory and meaning strongly.

Robertkem

t-walls-of-kuwait-iraq – Historical and impactful, visuals convey memory and meaning strongly.

Robertkem

t-walls-of-kuwait-iraq – Historical and impactful, visuals convey memory and meaning strongly.

Robertkem

t-walls-of-kuwait-iraq – Historical and impactful, visuals convey memory and meaning strongly.

Robertkem

t-walls-of-kuwait-iraq – Historical and impactful, visuals convey memory and meaning strongly.

Robertkem

t-walls-of-kuwait-iraq – Historical and impactful, visuals convey memory and meaning strongly.

Robertkem

t-walls-of-kuwait-iraq – Historical and impactful, visuals convey memory and meaning strongly.

JamesAveri

rideformissingchildren – Heartfelt cause, presentation honors the mission beautifully and respectfully.

JamesAveri

rideformissingchildren – Heartfelt cause, presentation honors the mission beautifully and respectfully.

JamesAveri

rideformissingchildren – Heartfelt cause, presentation honors the mission beautifully and respectfully.

JamesAveri

rideformissingchildren – Heartfelt cause, presentation honors the mission beautifully and respectfully.

JamesAveri

rideformissingchildren – Heartfelt cause, presentation honors the mission beautifully and respectfully.

JamesAveri

rideformissingchildren – Heartfelt cause, presentation honors the mission beautifully and respectfully.

JamesAveri

rideformissingchildren – Heartfelt cause, presentation honors the mission beautifully and respectfully.

JamesAveri

rideformissingchildren – Heartfelt cause, presentation honors the mission beautifully and respectfully.

JamesAveri

rideformissingchildren – Heartfelt cause, presentation honors the mission beautifully and respectfully.

JamesAveri

rideformissingchildren – Heartfelt cause, presentation honors the mission beautifully and respectfully.

JamesAveri

rideformissingchildren – Heartfelt cause, presentation honors the mission beautifully and respectfully.

JamesAveri

rideformissingchildren – Heartfelt cause, presentation honors the mission beautifully and respectfully.

JamesAveri

rideformissingchildren – Heartfelt cause, presentation honors the mission beautifully and respectfully.

JamesAveri

rideformissingchildren – Heartfelt cause, presentation honors the mission beautifully and respectfully.

JamesAveri

rideformissingchildren – Heartfelt cause, presentation honors the mission beautifully and respectfully.

JamesAveri

rideformissingchildren – Heartfelt cause, presentation honors the mission beautifully and respectfully.

JamesAveri

rideformissingchildren – Heartfelt cause, presentation honors the mission beautifully and respectfully.

JamesAveri

rideformissingchildren – Heartfelt cause, presentation honors the mission beautifully and respectfully.

JamesAveri

rideformissingchildren – Heartfelt cause, presentation honors the mission beautifully and respectfully.

JamesAveri

rideformissingchildren – Heartfelt cause, presentation honors the mission beautifully and respectfully.

JamesAveri

rideformissingchildren – Heartfelt cause, presentation honors the mission beautifully and respectfully.

JamesAveri

rideformissingchildren – Heartfelt cause, presentation honors the mission beautifully and respectfully.

JamesAveri

rideformissingchildren – Heartfelt cause, presentation honors the mission beautifully and respectfully.

JamesAveri

rideformissingchildren – Heartfelt cause, presentation honors the mission beautifully and respectfully.

JamesAveri

rideformissingchildren – Heartfelt cause, presentation honors the mission beautifully and respectfully.

JamesAveri

rideformissingchildren – Heartfelt cause, presentation honors the mission beautifully and respectfully.

JamesAveri

rideformissingchildren – Heartfelt cause, presentation honors the mission beautifully and respectfully.

JamesAveri

rideformissingchildren – Heartfelt cause, presentation honors the mission beautifully and respectfully.

JamesAveri

rideformissingchildren – Heartfelt cause, presentation honors the mission beautifully and respectfully.

JamesAveri

rideformissingchildren – Heartfelt cause, presentation honors the mission beautifully and respectfully.

RomainAveri

romain4reform – Clear, reform-focused tone, visuals convey honesty and strong leadership.

RomainAveri

romain4reform – Clear, reform-focused tone, visuals convey honesty and strong leadership.

RomainAveri

romain4reform – Clear, reform-focused tone, visuals convey honesty and strong leadership.

RomainAveri

romain4reform – Clear, reform-focused tone, visuals convey honesty and strong leadership.

RomainAveri

romain4reform – Clear, reform-focused tone, visuals convey honesty and strong leadership.

RomainAveri

romain4reform – Clear, reform-focused tone, visuals convey honesty and strong leadership.

RomainAveri

romain4reform – Clear, reform-focused tone, visuals convey honesty and strong leadership.

RomainAveri

romain4reform – Clear, reform-focused tone, visuals convey honesty and strong leadership.

RomainAveri

romain4reform – Clear, reform-focused tone, visuals convey honesty and strong leadership.

RomainAveri

romain4reform – Clear, reform-focused tone, visuals convey honesty and strong leadership.

RomainAveri

romain4reform – Clear, reform-focused tone, visuals convey honesty and strong leadership.

RomainAveri

romain4reform – Clear, reform-focused tone, visuals convey honesty and strong leadership.

RomainAveri

romain4reform – Clear, reform-focused tone, visuals convey honesty and strong leadership.

RomainAveri

romain4reform – Clear, reform-focused tone, visuals convey honesty and strong leadership.

RomainAveri

romain4reform – Clear, reform-focused tone, visuals convey honesty and strong leadership.

RomainAveri

romain4reform – Clear, reform-focused tone, visuals convey honesty and strong leadership.

RomainAveri

romain4reform – Clear, reform-focused tone, visuals convey honesty and strong leadership.

RomainAveri

romain4reform – Clear, reform-focused tone, visuals convey honesty and strong leadership.

RomainAveri

romain4reform – Clear, reform-focused tone, visuals convey honesty and strong leadership.

RomainAveri

romain4reform – Clear, reform-focused tone, visuals convey honesty and strong leadership.

RomainAveri

romain4reform – Clear, reform-focused tone, visuals convey honesty and strong leadership.

RomainAveri

romain4reform – Clear, reform-focused tone, visuals convey honesty and strong leadership.

RomainAveri

romain4reform – Clear, reform-focused tone, visuals convey honesty and strong leadership.

RomainAveri

romain4reform – Clear, reform-focused tone, visuals convey honesty and strong leadership.

RomainAveri

romain4reform – Clear, reform-focused tone, visuals convey honesty and strong leadership.

RomainAveri

romain4reform – Clear, reform-focused tone, visuals convey honesty and strong leadership.

RomainAveri

romain4reform – Clear, reform-focused tone, visuals convey honesty and strong leadership.

RomainAveri

romain4reform – Clear, reform-focused tone, visuals convey honesty and strong leadership.

RomainAveri

romain4reform – Clear, reform-focused tone, visuals convey honesty and strong leadership.

RomainAveri

romain4reform – Clear, reform-focused tone, visuals convey honesty and strong leadership.

Davidisorp

kim4commonsense – The campaign feels approachable, visuals and tone are relatable.

Davidisorp

kim4commonsense – The campaign feels approachable, visuals and tone are relatable.

Davidisorp

kim4commonsense – The campaign feels approachable, visuals and tone are relatable.

Davidisorp

kim4commonsense – The campaign feels approachable, visuals and tone are relatable.

Davidisorp

kim4commonsense – The campaign feels approachable, visuals and tone are relatable.

Davidisorp

kim4commonsense – The campaign feels approachable, visuals and tone are relatable.

Davidisorp

kim4commonsense – The campaign feels approachable, visuals and tone are relatable.

Davidisorp

kim4commonsense – The campaign feels approachable, visuals and tone are relatable.

Davidisorp

kim4commonsense – The campaign feels approachable, visuals and tone are relatable.

Davidisorp

kim4commonsense – The campaign feels approachable, visuals and tone are relatable.

Davidisorp

kim4commonsense – The campaign feels approachable, visuals and tone are relatable.

Davidisorp

kim4commonsense – The campaign feels approachable, visuals and tone are relatable.

Davidisorp

kim4commonsense – The campaign feels approachable, visuals and tone are relatable.

Davidisorp

kim4commonsense – The campaign feels approachable, visuals and tone are relatable.

Davidisorp

kim4commonsense – The campaign feels approachable, visuals and tone are relatable.

Davidisorp

kim4commonsense – The campaign feels approachable, visuals and tone are relatable.

Davidisorp

kim4commonsense – The campaign feels approachable, visuals and tone are relatable.

Davidisorp

kim4commonsense – The campaign feels approachable, visuals and tone are relatable.

Davidisorp

kim4commonsense – The campaign feels approachable, visuals and tone are relatable.

Davidisorp

kim4commonsense – The campaign feels approachable, visuals and tone are relatable.

Davidisorp

kim4commonsense – The campaign feels approachable, visuals and tone are relatable.

Davidisorp

kim4commonsense – The campaign feels approachable, visuals and tone are relatable.

Davidisorp

kim4commonsense – The campaign feels approachable, visuals and tone are relatable.

Davidisorp

kim4commonsense – The campaign feels approachable, visuals and tone are relatable.

Davidisorp

kim4commonsense – The campaign feels approachable, visuals and tone are relatable.

Davidisorp

kim4commonsense – The campaign feels approachable, visuals and tone are relatable.

Davidisorp

kim4commonsense – The campaign feels approachable, visuals and tone are relatable.

Davidisorp

kim4commonsense – The campaign feels approachable, visuals and tone are relatable.

Davidisorp

kim4commonsense – The campaign feels approachable, visuals and tone are relatable.

Davidisorp

kim4commonsense – The campaign feels approachable, visuals and tone are relatable.

Gabrielfathy

The Inheritance Games Canada: A thrilling mystery game where players unravel secrets, solve puzzles, and compete for a billionaire’s fortune. Perfect for fans of strategy and suspense: official Inheritance Games website

Amandaisorp

electamandamurphy – Inspiring campaign, message of progress and empathy shines through.

Amandaisorp

electamandamurphy – Inspiring campaign, message of progress and empathy shines through.

Amandaisorp

electamandamurphy – Inspiring campaign, message of progress and empathy shines through.

Amandaisorp

electamandamurphy – Inspiring campaign, message of progress and empathy shines through.

Amandaisorp

electamandamurphy – Inspiring campaign, message of progress and empathy shines through.

Amandaisorp

electamandamurphy – Inspiring campaign, message of progress and empathy shines through.

Amandaisorp

electamandamurphy – Inspiring campaign, message of progress and empathy shines through.

Amandaisorp

electamandamurphy – Inspiring campaign, message of progress and empathy shines through.

Amandaisorp

electamandamurphy – Inspiring campaign, message of progress and empathy shines through.

Amandaisorp

electamandamurphy – Inspiring campaign, message of progress and empathy shines through.

Amandaisorp

electamandamurphy – Inspiring campaign, message of progress and empathy shines through.

Amandaisorp

electamandamurphy – Inspiring campaign, message of progress and empathy shines through.

Amandaisorp

electamandamurphy – Inspiring campaign, message of progress and empathy shines through.

Amandaisorp

electamandamurphy – Inspiring campaign, message of progress and empathy shines through.

Amandaisorp

electamandamurphy – Inspiring campaign, message of progress and empathy shines through.

Amandaisorp

electamandamurphy – Inspiring campaign, message of progress and empathy shines through.

Amandaisorp

electamandamurphy – Inspiring campaign, message of progress and empathy shines through.

Amandaisorp

electamandamurphy – Inspiring campaign, message of progress and empathy shines through.

Amandaisorp

electamandamurphy – Inspiring campaign, message of progress and empathy shines through.

Amandaisorp

electamandamurphy – Inspiring campaign, message of progress and empathy shines through.

Amandaisorp

electamandamurphy – Inspiring campaign, message of progress and empathy shines through.

Amandaisorp

electamandamurphy – Inspiring campaign, message of progress and empathy shines through.

Amandaisorp

electamandamurphy – Inspiring campaign, message of progress and empathy shines through.

Amandaisorp

electamandamurphy – Inspiring campaign, message of progress and empathy shines through.

Amandaisorp

electamandamurphy – Inspiring campaign, message of progress and empathy shines through.

Amandaisorp

electamandamurphy – Inspiring campaign, message of progress and empathy shines through.

Amandaisorp

electamandamurphy – Inspiring campaign, message of progress and empathy shines through.

Amandaisorp

electamandamurphy – Inspiring campaign, message of progress and empathy shines through.

Amandaisorp

electamandamurphy – Inspiring campaign, message of progress and empathy shines through.

Amandaisorp

electamandamurphy – Inspiring campaign, message of progress and empathy shines through.

MelvinUnoxy

Замена лобового стекла автомобиля — это ответственная процедура, требующая профессионализма и качественного материала. Если стекло повреждено трещинами или сколами, важно своевременно заменить лобовое стекло, чтобы избежать ухудшения видимости и повышения риска аварии. Специалисты быстро и аккуратно выполнят работу, используя современное оборудование и проверенные технологии: Замена лобового стекла автомобиля

Samuellar

southbyfreenoms – Fun, quirky branding with energetic layout and friendly design.

Samuellar

southbyfreenoms – Fun, quirky branding with energetic layout and friendly design.

Samuellar

southbyfreenoms – Fun, quirky branding with energetic layout and friendly design.

Samuellar

southbyfreenoms – Fun, quirky branding with energetic layout and friendly design.

Samuellar

southbyfreenoms – Fun, quirky branding with energetic layout and friendly design.

Samuellar

southbyfreenoms – Fun, quirky branding with energetic layout and friendly design.

Samuellar

southbyfreenoms – Fun, quirky branding with energetic layout and friendly design.

Samuellar

southbyfreenoms – Fun, quirky branding with energetic layout and friendly design.

Samuellar

southbyfreenoms – Fun, quirky branding with energetic layout and friendly design.

Samuellar

southbyfreenoms – Fun, quirky branding with energetic layout and friendly design.

Samuellar

southbyfreenoms – Fun, quirky branding with energetic layout and friendly design.

Samuellar

southbyfreenoms – Fun, quirky branding with energetic layout and friendly design.

Samuellar

southbyfreenoms – Fun, quirky branding with energetic layout and friendly design.

Samuellar

southbyfreenoms – Fun, quirky branding with energetic layout and friendly design.

Samuellar

southbyfreenoms – Fun, quirky branding with energetic layout and friendly design.

Samuellar

southbyfreenoms – Fun, quirky branding with energetic layout and friendly design.

Samuellar

southbyfreenoms – Fun, quirky branding with energetic layout and friendly design.

Samuellar

southbyfreenoms – Fun, quirky branding with energetic layout and friendly design.

Samuellar

southbyfreenoms – Fun, quirky branding with energetic layout and friendly design.

Samuellar

southbyfreenoms – Fun, quirky branding with energetic layout and friendly design.

Samuellar

southbyfreenoms – Fun, quirky branding with energetic layout and friendly design.

Samuellar

southbyfreenoms – Fun, quirky branding with energetic layout and friendly design.

Samuellar

southbyfreenoms – Fun, quirky branding with energetic layout and friendly design.

Samuellar

southbyfreenoms – Fun, quirky branding with energetic layout and friendly design.

Samuellar

southbyfreenoms – Fun, quirky branding with energetic layout and friendly design.

Samuellar

southbyfreenoms – Fun, quirky branding with energetic layout and friendly design.

Samuellar

southbyfreenoms – Fun, quirky branding with energetic layout and friendly design.

Samuellar

southbyfreenoms – Fun, quirky branding with energetic layout and friendly design.

Samuellar

southbyfreenoms – Fun, quirky branding with energetic layout and friendly design.

Samuellar

southbyfreenoms – Fun, quirky branding with energetic layout and friendly design.

HarryAveri

harryandeddies – Cozy restaurant vibe, visuals and menu presentation feel deliciously inviting.

HarryAveri

harryandeddies – Cozy restaurant vibe, visuals and menu presentation feel deliciously inviting.

HarryAveri

harryandeddies – Cozy restaurant vibe, visuals and menu presentation feel deliciously inviting.

HarryAveri

harryandeddies – Cozy restaurant vibe, visuals and menu presentation feel deliciously inviting.

HarryAveri

harryandeddies – Cozy restaurant vibe, visuals and menu presentation feel deliciously inviting.

HarryAveri

harryandeddies – Cozy restaurant vibe, visuals and menu presentation feel deliciously inviting.

HarryAveri

harryandeddies – Cozy restaurant vibe, visuals and menu presentation feel deliciously inviting.

HarryAveri

harryandeddies – Cozy restaurant vibe, visuals and menu presentation feel deliciously inviting.

HarryAveri

harryandeddies – Cozy restaurant vibe, visuals and menu presentation feel deliciously inviting.

HarryAveri

harryandeddies – Cozy restaurant vibe, visuals and menu presentation feel deliciously inviting.

HarryAveri

harryandeddies – Cozy restaurant vibe, visuals and menu presentation feel deliciously inviting.

HarryAveri

harryandeddies – Cozy restaurant vibe, visuals and menu presentation feel deliciously inviting.

HarryAveri

harryandeddies – Cozy restaurant vibe, visuals and menu presentation feel deliciously inviting.

HarryAveri

harryandeddies – Cozy restaurant vibe, visuals and menu presentation feel deliciously inviting.

HarryAveri

harryandeddies – Cozy restaurant vibe, visuals and menu presentation feel deliciously inviting.

HarryAveri

harryandeddies – Cozy restaurant vibe, visuals and menu presentation feel deliciously inviting.

HarryAveri

harryandeddies – Cozy restaurant vibe, visuals and menu presentation feel deliciously inviting.

HarryAveri

harryandeddies – Cozy restaurant vibe, visuals and menu presentation feel deliciously inviting.

HarryAveri

harryandeddies – Cozy restaurant vibe, visuals and menu presentation feel deliciously inviting.

HarryAveri

harryandeddies – Cozy restaurant vibe, visuals and menu presentation feel deliciously inviting.

HarryAveri

harryandeddies – Cozy restaurant vibe, visuals and menu presentation feel deliciously inviting.

HarryAveri

harryandeddies – Cozy restaurant vibe, visuals and menu presentation feel deliciously inviting.

HarryAveri

harryandeddies – Cozy restaurant vibe, visuals and menu presentation feel deliciously inviting.

HarryAveri

harryandeddies – Cozy restaurant vibe, visuals and menu presentation feel deliciously inviting.

HarryAveri

harryandeddies – Cozy restaurant vibe, visuals and menu presentation feel deliciously inviting.

HarryAveri

harryandeddies – Cozy restaurant vibe, visuals and menu presentation feel deliciously inviting.

HarryAveri

harryandeddies – Cozy restaurant vibe, visuals and menu presentation feel deliciously inviting.

HarryAveri

harryandeddies – Cozy restaurant vibe, visuals and menu presentation feel deliciously inviting.

HarryAveri

harryandeddies – Cozy restaurant vibe, visuals and menu presentation feel deliciously inviting.

HarryAveri

harryandeddies – Cozy restaurant vibe, visuals and menu presentation feel deliciously inviting.

Michaellar

cuttingthered – Sharp branding, message delivers confidence and determination effectively.

Michaellar

cuttingthered – Sharp branding, message delivers confidence and determination effectively.

Michaellar

cuttingthered – Sharp branding, message delivers confidence and determination effectively.

Michaellar

cuttingthered – Sharp branding, message delivers confidence and determination effectively.

Michaellar

cuttingthered – Sharp branding, message delivers confidence and determination effectively.

Michaellar

cuttingthered – Sharp branding, message delivers confidence and determination effectively.

Michaellar

cuttingthered – Sharp branding, message delivers confidence and determination effectively.

Michaellar

cuttingthered – Sharp branding, message delivers confidence and determination effectively.

Michaellar

cuttingthered – Sharp branding, message delivers confidence and determination effectively.

Michaellar

cuttingthered – Sharp branding, message delivers confidence and determination effectively.

Michaellar

cuttingthered – Sharp branding, message delivers confidence and determination effectively.

Michaellar

cuttingthered – Sharp branding, message delivers confidence and determination effectively.

Michaellar

cuttingthered – Sharp branding, message delivers confidence and determination effectively.

Michaellar

cuttingthered – Sharp branding, message delivers confidence and determination effectively.

Michaellar

cuttingthered – Sharp branding, message delivers confidence and determination effectively.

Michaellar

cuttingthered – Sharp branding, message delivers confidence and determination effectively.

Michaellar

cuttingthered – Sharp branding, message delivers confidence and determination effectively.

Michaellar

cuttingthered – Sharp branding, message delivers confidence and determination effectively.

Michaellar

cuttingthered – Sharp branding, message delivers confidence and determination effectively.

Michaellar

cuttingthered – Sharp branding, message delivers confidence and determination effectively.

Michaellar

cuttingthered – Sharp branding, message delivers confidence and determination effectively.

Michaellar

cuttingthered – Sharp branding, message delivers confidence and determination effectively.

Michaellar

cuttingthered – Sharp branding, message delivers confidence and determination effectively.

Michaellar

cuttingthered – Sharp branding, message delivers confidence and determination effectively.

Michaellar

cuttingthered – Sharp branding, message delivers confidence and determination effectively.

Michaellar

cuttingthered – Sharp branding, message delivers confidence and determination effectively.

Michaellar

cuttingthered – Sharp branding, message delivers confidence and determination effectively.

Michaellar

cuttingthered – Sharp branding, message delivers confidence and determination effectively.

Michaellar

cuttingthered – Sharp branding, message delivers confidence and determination effectively.

Tinalex

tinacurrin – Artistic and bold, site radiates passion and expressive creativity.

Tinalex

tinacurrin – Artistic and bold, site radiates passion and expressive creativity.

Tinalex

tinacurrin – Artistic and bold, site radiates passion and expressive creativity.

Tinalex

tinacurrin – Artistic and bold, site radiates passion and expressive creativity.

Tinalex

tinacurrin – Artistic and bold, site radiates passion and expressive creativity.

Tinalex

tinacurrin – Artistic and bold, site radiates passion and expressive creativity.

Tinalex

tinacurrin – Artistic and bold, site radiates passion and expressive creativity.

Tinalex

tinacurrin – Artistic and bold, site radiates passion and expressive creativity.

Tinalex

tinacurrin – Artistic and bold, site radiates passion and expressive creativity.

Tinalex

tinacurrin – Artistic and bold, site radiates passion and expressive creativity.

Tinalex

tinacurrin – Artistic and bold, site radiates passion and expressive creativity.

Tinalex

tinacurrin – Artistic and bold, site radiates passion and expressive creativity.

Tinalex

tinacurrin – Artistic and bold, site radiates passion and expressive creativity.

Tinalex

tinacurrin – Artistic and bold, site radiates passion and expressive creativity.

Tinalex

tinacurrin – Artistic and bold, site radiates passion and expressive creativity.

Tinalex

tinacurrin – Artistic and bold, site radiates passion and expressive creativity.

Tinalex

tinacurrin – Artistic and bold, site radiates passion and expressive creativity.

Tinalex

tinacurrin – Artistic and bold, site radiates passion and expressive creativity.

Tinalex

tinacurrin – Artistic and bold, site radiates passion and expressive creativity.

Tinalex

tinacurrin – Artistic and bold, site radiates passion and expressive creativity.

Tinalex

tinacurrin – Artistic and bold, site radiates passion and expressive creativity.

Tinalex

tinacurrin – Artistic and bold, site radiates passion and expressive creativity.

Tinalex

tinacurrin – Artistic and bold, site radiates passion and expressive creativity.

Tinalex

tinacurrin – Artistic and bold, site radiates passion and expressive creativity.

Tinalex

tinacurrin – Artistic and bold, site radiates passion and expressive creativity.

Tinalex

tinacurrin – Artistic and bold, site radiates passion and expressive creativity.

Tinalex

tinacurrin – Artistic and bold, site radiates passion and expressive creativity.

Tinalex

tinacurrin – Artistic and bold, site radiates passion and expressive creativity.

Tinalex

tinacurrin – Artistic and bold, site radiates passion and expressive creativity.

Tinalex

tinacurrin – Artistic and bold, site radiates passion and expressive creativity.

Richardscugs

nyscanalconference – Informative and organized, layout suits event communication well.

Richardscugs

nyscanalconference – Informative and organized, layout suits event communication well.

Richardscugs

nyscanalconference – Informative and organized, layout suits event communication well.

Richardscugs

nyscanalconference – Informative and organized, layout suits event communication well.

Richardscugs

nyscanalconference – Informative and organized, layout suits event communication well.

Richardscugs

nyscanalconference – Informative and organized, layout suits event communication well.

Richardscugs

nyscanalconference – Informative and organized, layout suits event communication well.

Richardscugs

nyscanalconference – Informative and organized, layout suits event communication well.

Richardscugs

nyscanalconference – Informative and organized, layout suits event communication well.

Richardscugs

nyscanalconference – Informative and organized, layout suits event communication well.

Richardscugs

nyscanalconference – Informative and organized, layout suits event communication well.

Richardscugs

nyscanalconference – Informative and organized, layout suits event communication well.

Richardscugs

nyscanalconference – Informative and organized, layout suits event communication well.

Richardscugs

nyscanalconference – Informative and organized, layout suits event communication well.

Richardscugs

nyscanalconference – Informative and organized, layout suits event communication well.

Richardscugs

nyscanalconference – Informative and organized, layout suits event communication well.

Richardscugs

nyscanalconference – Informative and organized, layout suits event communication well.

Richardscugs

nyscanalconference – Informative and organized, layout suits event communication well.

Richardscugs

nyscanalconference – Informative and organized, layout suits event communication well.

Richardscugs

nyscanalconference – Informative and organized, layout suits event communication well.

Richardscugs

nyscanalconference – Informative and organized, layout suits event communication well.

Richardscugs

nyscanalconference – Informative and organized, layout suits event communication well.

Richardscugs

nyscanalconference – Informative and organized, layout suits event communication well.

Richardscugs

nyscanalconference – Informative and organized, layout suits event communication well.

Richardscugs

nyscanalconference – Informative and organized, layout suits event communication well.

Richardscugs

nyscanalconference – Informative and organized, layout suits event communication well.

Richardscugs

nyscanalconference – Informative and organized, layout suits event communication well.

Richardscugs

nyscanalconference – Informative and organized, layout suits event communication well.

Richardscugs

nyscanalconference – Informative and organized, layout suits event communication well.

Richardscugs

nyscanalconference – Informative and organized, layout suits event communication well.

Justinfib

justinhicksformissouri – Strong campaign message, design feels authentic and community-focused.

Justinfib

justinhicksformissouri – Strong campaign message, design feels authentic and community-focused.

Justinfib

justinhicksformissouri – Strong campaign message, design feels authentic and community-focused.

Justinfib

justinhicksformissouri – Strong campaign message, design feels authentic and community-focused.

Justinfib

justinhicksformissouri – Strong campaign message, design feels authentic and community-focused.

Justinfib

justinhicksformissouri – Strong campaign message, design feels authentic and community-focused.

Justinfib

justinhicksformissouri – Strong campaign message, design feels authentic and community-focused.

Justinfib

justinhicksformissouri – Strong campaign message, design feels authentic and community-focused.

Justinfib

justinhicksformissouri – Strong campaign message, design feels authentic and community-focused.

Justinfib

justinhicksformissouri – Strong campaign message, design feels authentic and community-focused.

Justinfib

justinhicksformissouri – Strong campaign message, design feels authentic and community-focused.

Justinfib

justinhicksformissouri – Strong campaign message, design feels authentic and community-focused.

Justinfib

justinhicksformissouri – Strong campaign message, design feels authentic and community-focused.

Justinfib

justinhicksformissouri – Strong campaign message, design feels authentic and community-focused.

Justinfib

justinhicksformissouri – Strong campaign message, design feels authentic and community-focused.

Justinfib

justinhicksformissouri – Strong campaign message, design feels authentic and community-focused.

Justinfib

justinhicksformissouri – Strong campaign message, design feels authentic and community-focused.

Justinfib